Sign up for expert insights, industry trends, and key updates—delivered straight to you.

At a time when the global interest rate environment exhibited increasing trajectory and volatility, and further worsened by recent events that shook the stability of and confidence towards financial markets, financial institutions need to be on top of their game in managing its various risk exposures.

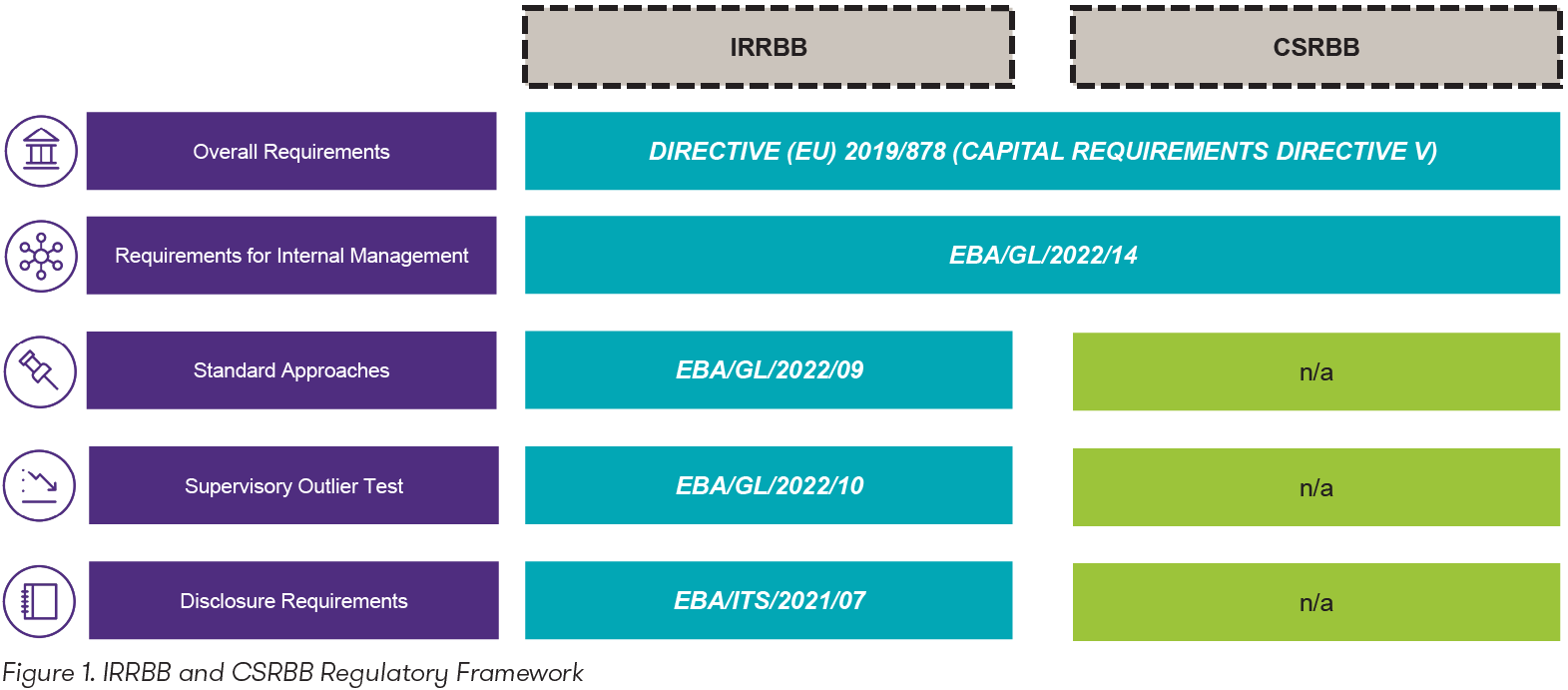

In October 2022, the European Bank Authority (EBA) has issued three Regulatory Technical Standards (RTS), providing specific guidelines on the management of what could potentially be considered as financial institutions’ largest risk exposures – interest rate risk in the banking book (IRRBB) and credit spread risk in the banking book (CSRBB). These three guidelines include:

- EBA/RTS/2022/09 – Guidelines on the standardized and simplified standardized methodologies for Economic Value of Equity (EVE) and Net Interest Income (NII)

- EBA/RTS/2022/10 – Guidelines on the supervisory outlier test (SOT) EVE and NII

- EBA/RTS/2022/14 – Guidelines on the internal management of IRRBB and CSRBB

While the new guidelines aim to strengthen the stress testing and risk management frameworks of financial institutions, these will impose more extensive deliverables from financial institutions’ risk, treasury and asset-liability management functions. The EBA expects financial institutions to comply with the updated requirements of IRRBB and CSRBB by 30 June 2023 and 31 December 2023, respectively, which is a relatively short timeframe, hence the need for financial institutions to act swiftly in adapting these measures.

Highlights on Regulatory Requirement Updates

In this article, we will discuss four key changes introduced by the new guidelines.

1. Changes to the Internal Management for IRRBB

Save for a few key changes, the requirements on the management of IRRBB under EBA/GL/2018/02 (the 2018 guidelines) have been carried over to the updated guidelines. These changes include:

- Non-maturity deposits (NMDs) from financial customers, with exception to operational deposits, are not subject to behavioural modelling.

- The assumed behavioural repricing date for retail and wholesale deposits from nonfinancial customers and operational deposits are constrained to a maximum weighted average repricing date of 5 years. EBA considers the application of the cap as a prudent approach to control a potentially overestimated profitability in the short-medium term, given the increasing interest rate environment and potential subsequent higher volatility in NMDs.

- The inclusion of set of criteria to determine whether internal systems are not considered satisfactory, which would require the financial institution to use the standardized approach. These criteria include:

- The implemented methods do not cover all material components of the interest rate risk (gap risk, basis risk, option risk), and/or measures do not capture in a robust manner all material dimensions of risk for significant assets, liabilities and off-balance sheet instruments in the banking book.

- The internal measurement system (IMS) are not calibrated, back-tested and reviewed in all their relevant parameters on an appropriate frequency and supported by a due governance and documentation that considers the nature, scale and complexity of the IRRBB inherent in the business mode and the financial institution’s activities.

2. Changes to the Internal Management for CRRBB

While the 2018 guidelines have provided general expectations for the identification and management of CSRBB, the provisions mostly focused on the internal management of IRRBB and CSRBB was relegated to having a residual definition. The new RTS now provides a proper perimeter for the scope of CSRBB.

CSRBB captures a combination of two elements:

- Changes in market liquidity spread – representing the liquidity premium sparking market appetite for investments as well as presence of willing buyers and sellers.

- Changes in market credit spread or market price of credit risk, which represents the credit risk premium required by market participants for a given credit quality.

By definition, CSRRBB does not include idiosyncratic credit spreads, which reflect the specific credit risk associated with the credit quality of the individual borrower, as this would generally be covered by another risk framework. However, for reasons of proportionality, EBA has given financial institutions the option to include credit spread components under CSRBB for as long as it is ensured that the measures will yield more conservative results.

Parallel to the management of IRRBB, guidelines for the management of CSRBB were fleshed out for financial institutions to ensure that CSRBB is included in its overall strategic and risk objectives, accompanied by appropriate governance arrangements and well-integrated processes.

3. Supervisory Outlier Test

The supervisory outlier test serves as a basis on which competent authorities may exercise their supervisory powers – such as setting additional own funds requirements, limitations of activities with excessive risks, and specifying modelling and parametric assumptions, among others – upon the occurrence of either:

- A reduction of the financial institution’s EVE risk measure greater than 15% of its Tier 1 capital; or

- A large decline of the financial institution’s NII risk measure, which is now defined as greater than 2.5% of its Tier 1 capital.

The new threshold for the EVE measure is 5% lower than previously mandated in the 2018 guidelines, which was set at 20%.

The six supervisory interest rate shock scenarios for the EVE risk measure from the 2018 guidelines have been retained and have been supplemented by two supervisory-defined interest rate shock scenarios for the NII risk measure.

The change in the EVE risk measure is computed with the assumption of a run-off balance sheet where maturing positions are not replaced. On the other hand, the NII risk measure is computed with the assumption of a constant balance sheet and considers interest income and interest expense over a one-year horizon, regardless of the maturity and the accounting treatment of the relevant interest rate-sensitive instruments. It should be noted that the NII risk is narrowly defined to interest income and interest expense only, hence excluding fair value changes from instruments in the banking book accounted at fair value. While the EBA acknowledges that the inclusion of fair value elements provides a more comprehensive view, limiting the NII risk measure to interest income and expense ensures comparability across different applicable accounting frameworks.

For the EVE risk measure, a maturity-dependent post shock interest rate floor shall be applied for each currency starting with -150 basis points for immediate maturity (i.e. overnight interest rates), which shall increase linearly by 3 basis points per year, eventually reaching zero for maturities for maturities 50 years onwards. In comparison to the 2018 guidelines, which had a starting maturity-dependent post shock floor of -100 basis points, the new floor is considered sufficiently prudent by the EBA, given future developments in the interest rates.

4. Standardized Approach on IRRBB

Article 84 of CRD V provides that competent authorities may require financial institutions to use a standardized approach in assessing the potential risks arising from IRRBB where internal systems implemented by financial institutions are not considered satisfactory. Unlike most standardized approaches under Pillar I, the standardized approach for IRRBB is not intended to determine an output floor against the financial institutions’ own internal methodologies nor is it intended to replace any internal methodologies. The new RTS facilitate the implementation of the standardized and simplified standardized approaches by providing prescriptive guidelines in the (1) identification of interest rate positions, (2) slotting of cash flows, (3) calculation of add-on factors and (4) determination of the standardized economic value of equity (EVE) and net interest income (NII) risk measures.

Read the full publication [ 407 kb ]