On 21st April 2021, the European Commission adopted Delegated Acts (non-legislative acts adopted by the European Commission to amend or supplement legislation) amending the current UCITS, AIFMD and MIFID II legislation as part of its wider initiative to continue transforming EU’s economy into a sustainable financial system and become carbon neutral by 2050. The Delegated Acts were developed following public consultation work carried out in 2018 and ESMA’s final report published in April 2019. These acts will focus on clients’ sustainability preferences and will place a new obligation on managers to identify these preferences and manage client portfolios accordingly. The changes will impact all EU firms that are subject to the AIFMD, UCITS and/or MiFID regulations.

The aim of these Delegated Acts are to:

- Ensure financial services and capital are reoriented towards sustainable investments; and,

- Promote economic activities that will contribute towards climate change mitigation.

The following legislation will be amended due to the ESG proposals:

- AIFMD Delegated Regulation 231/2013/EU;

- UCITS Implementing Directive 2010/43/EU;

- MiFID Delegated Regulation 2017/565/EU; and,

- MiFID Delegated Directive 2017/593/EU.

What are the new requirements?

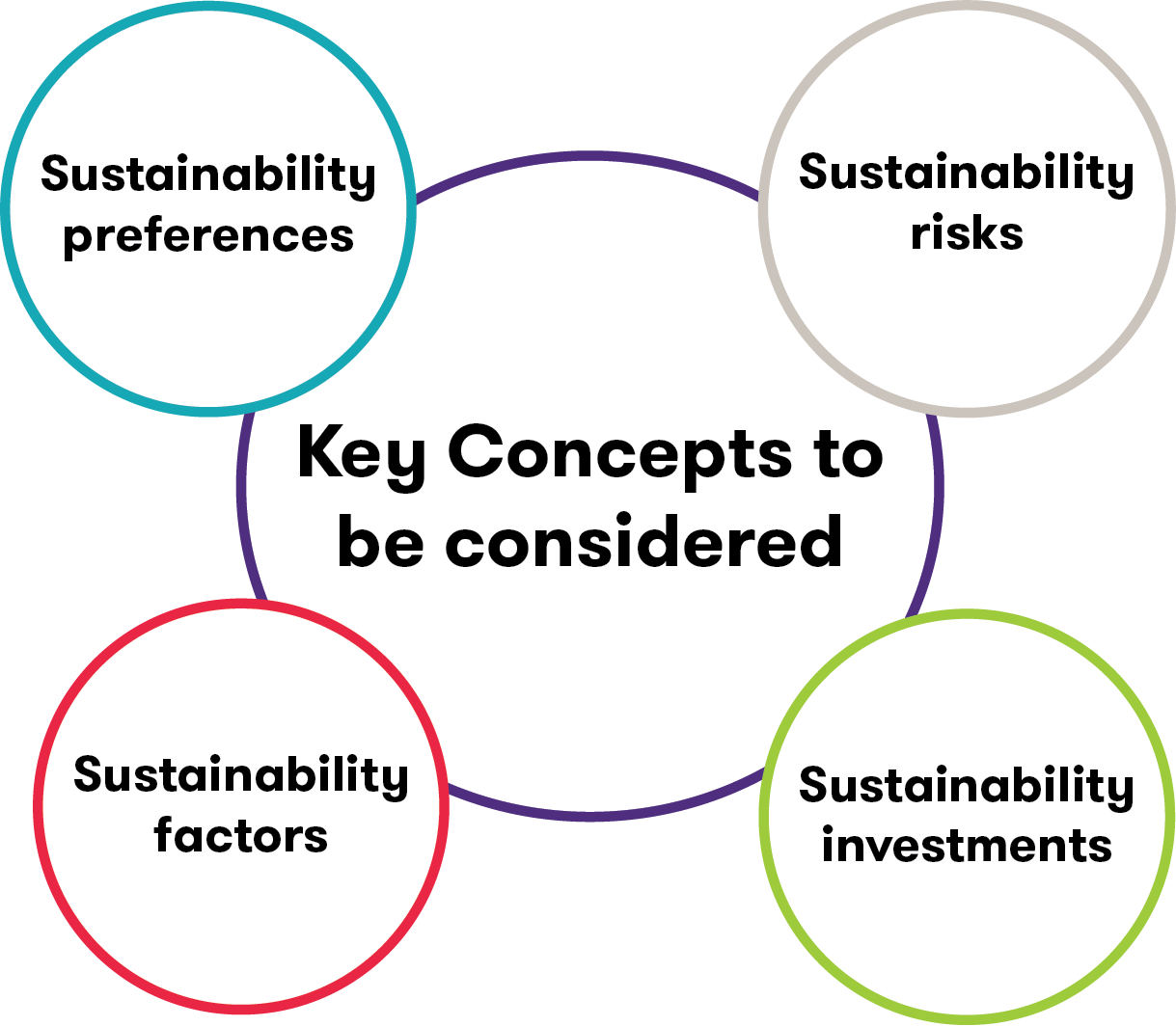

The Delegated Acts suggest an amended approach to existing organisational/governance and conduct of business requirements. They also introduce new key concepts and factors on sustainability that need to be considered by firms when adapting their processes in line with the proposals.

The Delegated Acts propose changes to the following:

- Suitability Assessments

As per current regulatory standards, companies must prepare a suitability assessment when providing investment advice or making a decision on a client’s portfolio. The assessment details why a particular advice or decision is suitable for the client and how it will allow the client to achieve their investment objectives. However, the assessments do not take into consideration the client’s sustainability preferences and whether they wish to integrate environmentally friendly financial instruments into their portfolio. The delegated act places an obligation on investment firms to review and update their suitability assessment processes and ensure consideration is given to clients’ sustainability preferences. A detailed disclosure should be provided to clients outlining the reasons for recommending an investment strategy and how it meets clients’ objectives and sustainability preferences.

- Product Governance

The changes will require the firms to analyse sustainability preferences when identifying the potential target market.

- Risk Management

The Delegated Acts require firms to consider and assess sustainability risks by using quantitative or qualitative data analysis. As such, existing risk management policies should be updated to reflect the risk of sustainability.

- Senior Management

The changes require senior management to be responsible for the integration of sustainability risks.

- Organisational Arrangements

Firms will need to ensure that appropriate organisational arrangements are in place and internal controls, systems and processes are re-designed to include analysis of sustainability factors and detection of sustainability risks.

- Conflicts of Interest

Firms will need to update their existing conflicts of interest identification process to include conflicts of interest that may arise as a result of integration of sustainability risks into the organisational arrangements.

- Due Diligence

Firms must consider sustainability risks and impacts of investment decisions on sustainability factors when performing due diligence.

- Resources

Firms are required to retain the necessary resources and expertise in order to effectively integrate sustainability risks.

The below table outlines the type of business activity the new requirements are applicable to:

What are the next steps?

Firms that are in scope of the AIFMD, UCITS and MiFID regimes need to become familiar with the changes that are applicable to their business activity and analyse how they will comply with the new obligations. Firms will need to review and update their existing business plan, systems and policies to incorporate the concept of sustainability into their daily operations. Adequate resources must be available and appropriate staff expertise is required to maintain compliance and eliminate activities that may present risks to preserving sustainability. This can be achieved by reviewing the current requirements and proposed changes via a gap analysis and implementing an action plan based on the results. The Delegated Acts are expected to apply in October 2022.