We have outlined below some of the key considerations contained within the Free Trade agreement between the EU and the UK. The agreement allows for tariff free trade between the EU and UK and sets out a new trading relationship between both parties.

Key points of Free Trade Agreement

- The FTA sets definitions and common ground for the parties, e.g. in relation to the classification and valuation of goods under the World Trade Organization General Agreement on Tariffs and Trade (GATT) provisions.

- Most significantly, it eliminates customs duties on all trade in goods originating in the UK or the EU. This is the most extensive trade agreement on tariffs the EU has ever completed.

- Rules of Origin which recognise EU and UK content as ‘originating’.

- Exporters will be able to self-certify the origin of the goods through a statement, e.g. on an invoice, thereby making it easier for importers to prove the origin of their products. Importers may also be able claim preference based on their own knowledge or information. A statement of origin can cover multiple identical shipments in a 12-month period.

- There are a number of other constructive measures in place to help facilitate trade, such as measures for the import of repaired and remanufactured goods, limits on the ability to impose import or export restrictions, and limits on fees and formalities in connection with import and export.

- The FTA confirms each party will have recourse to trade remedies such as anti-dumping and countervailing duties. Trade remedies protect domestic industries against injury caused by unfair trading practices.

- There is mutual recognition of Authorised Economic Operator (AEO) programs, which will help to reduce the administrative burden on businesses.

- There are common provisions on areas such as risk management and post-clearance audit, review and appeal processes, temporary admission, publication of information, customs brokers, non-requirement of pre-shipment inspections and relations with the business community. The UK and the EU agree to facilitate roll-on roll-off (Ro-Ro) traffic (although the provisions do not go as far as the UK’s initial ask ).

- The movement of goods between GB and Northern Ireland will be subject to special rules as per the Northern Ireland Protocol. In essence trade in goods between GB and NI will be treated as if NI remained part of the EU

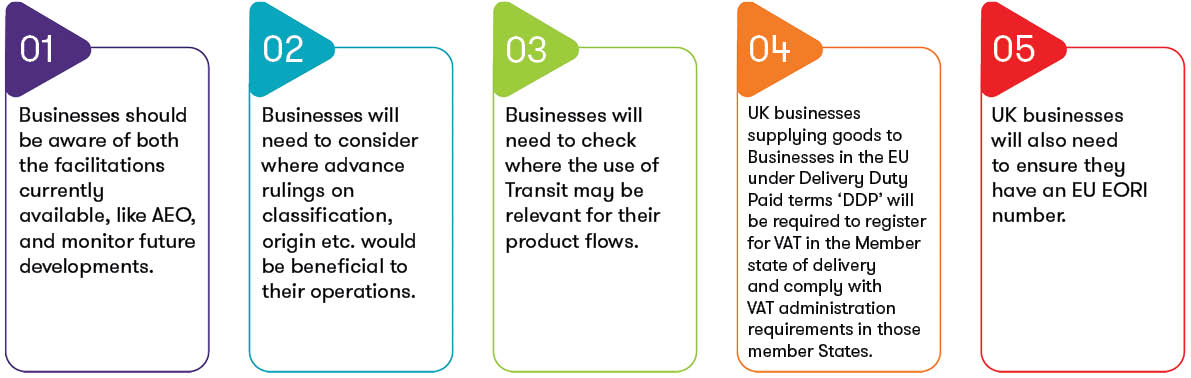

What are the actions for business?

Businesses will need to prepare for the impact of the loss of freedom of movement of goods between the EU and the UK. In particular, this means customs compliance obligations arise for goods moving between the EU and the UK. The UK will phase in the introduction of full border control measures – with a six-month period until import declarations need to be submitted for most goods. However, full border control measures will apply immediately in the EU from 1 January 2021.

In order to qualify for duty free access, businesses will need to check they meet the Rules of Origin in order to benefit from the preferential zero duty rate. In addition, businesses will need to manage a number of customs requirements, such as classifying and valuing goods and determining which goods are subject to licensing restrictions etc.

Business should review and monitor the details of the UK’s Trade Remedies policy to mitigate the potential economic impact of trade solutions on individual supply chains (e.g. anti-dumping duty), and monitor their status and proposed duration.

Businesses should also monitor the development of the new FTA terms and associated guidance during 2021 in order to be in a position to avail of any future simplifications.

While an agreement has been reached which most commentators, agree is better than a “no deal” scenario. The details of the agreement will need to be scrutinised in further detail to ensure businesses are compliant.