EU Mandatory Disclosure reporting rules came into effect in July 2020, however due to the impacts of COVID-19 pandemic the reporting deadline was deferred until January 2021. The first reports are due by the end of January. Are you ready to file your reports with the tax authorities?

DAC 6 applies to cross-border tax arrangements which meet one or more specified characteristics (“hallmarks”) and concern either more than one EU country or an EU country and a non-EU country. Subsequently, all tax authorities across the EU will exchange the received reportable disclosures amongst one another on a quarterly basis.

Our DAC6 EU mandatory disclosure brochure will provide you with more details.

When will reporting commence?

Revenue’s DAC6 filing portal opened on 1 January 2021 and the first reports are due by 31 January 2021. Intermediaries and taxpayers are required to file information with their national tax authority within 30 days of the earliest of the following:

(a) on the day after the arrangement is made available for implementation,

(b) on the day after the arrangement is ready for implementation, or

(c) when the first step in the implementation of the arrangement was taken, whichever occurs first.

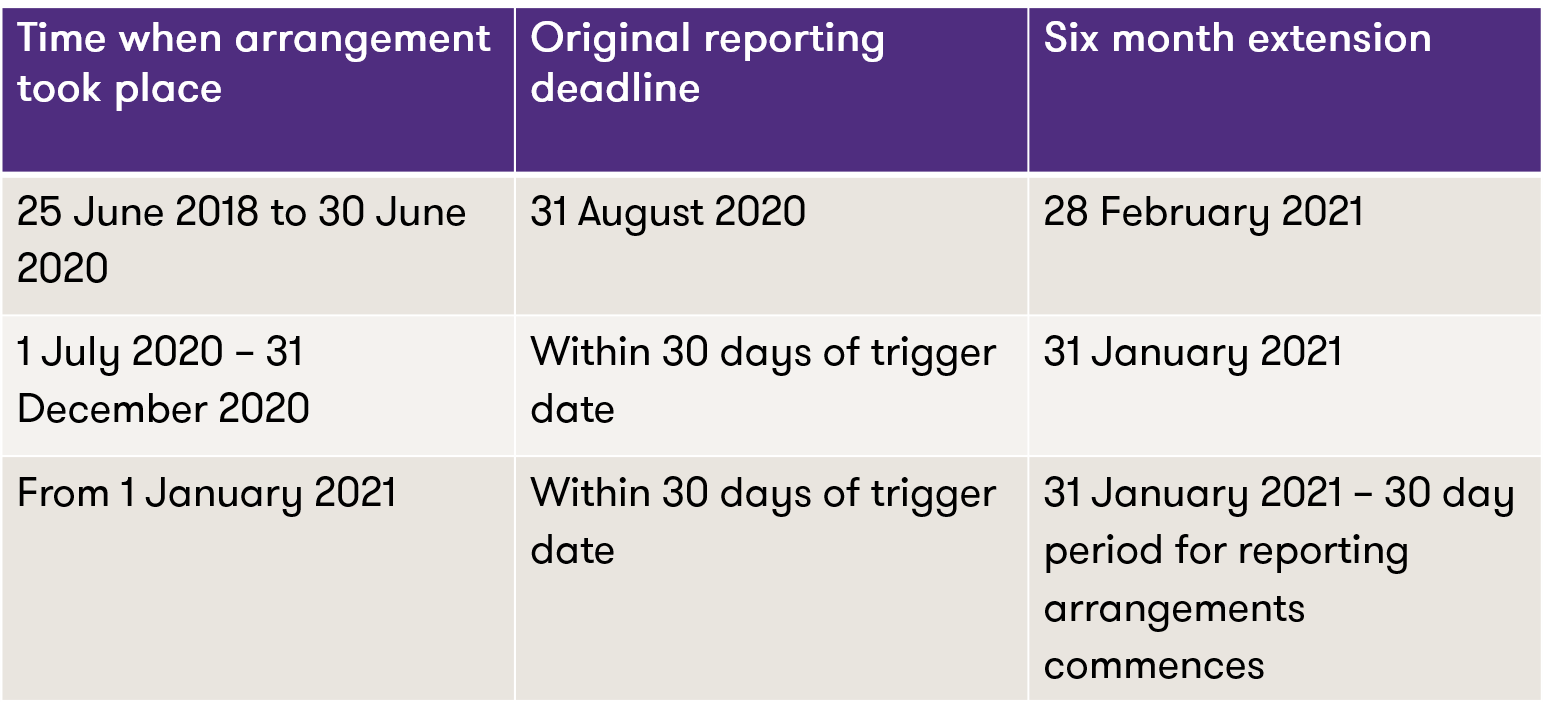

Due to the impact of the COVID-19 pandemic the reporting deadlines for certain arrangements were extended by six months. The original and extended reporting deadlines are set out below.

Penalties for non-compliance

Penalties for non-compliance are substantial and vary across different jurisdictions. Penalties in Ireland are as follows:

- One-off €4,000 plus €100 for every day late for non-compliance once notified by Revenue;

- Up to €500 per day where arrangement not reported within 30 days; and

- Up to €5,000 for failure to include report reference number in annual tax return.

How can Grant Thornton help?

We can assist you with the review and assessment of transactions during the transition period to identify any reportable arrangements. We can also assist you with ongoing compliance requirements and implementing internal procedures to help identify any reportable arrangements going forward.

What next?

Contact your Grant Thornton adviser to discuss your obligations under DAC6 and how we can assist you in implementing effective processes to ensure that you fully satisfy your reporting requirements.